IDBI Bank Central Bank Digital Currency

IDBI Bank Central Bank Digital Currency

Central Bank Digital Currency (CBDC) is the legal tender issued by the Reserve Bank of India (RBI) in a digital form, represented as Digital Rupee or e₹. It is the digital form of India’s physical currency, the Rupee (₹), and is fully interchangeable with existing currency at par (1:1). Just like traditional banknotes, CBDC is accepted as a medium of payment and legal tender. Its digital nature makes transactions faster, simpler, and more secure. It combines the trust of physical currency with the convenience and efficiency of digital payments, offering all the benefits of modern digital money.

Primary Goals:

- Reduce cash-handling costs and enhance payment transparency.

- Broaden financial inclusion especially in offline and remote zones.

- Enable programmable use cases: subsidies, travel allowances, geo-locked payments.

- Improve settlement speed and cross-border efficiency.

IDBI eRupee Mobile App

For retail usage, the Bank has developed a digital wallet based “eRupee” mobile application. Using this app, user can transact with any CBDC user or merchant through mobile numbers and QR codes.

Currently user can load money into wallet, sent it to beneficiary via mobile number and QR, collect money from beneficiary via QR and Redeem balance in to linked account.

Additionally, with UPI interoperability, users can make payments in digital rupee (CBDC) to any UPI-enabled individual or merchant by scanning their QR codes.

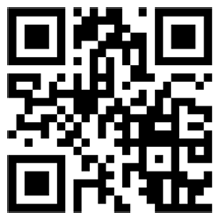

Download App

|

||

|---|---|---|

Getting started with IDBI eRupee (CBDC App)

- Step 1: Download IDBI eRupee App by scanning QR available on website or from Apple App Store/ Android Play Store

- Step 2: Install app and start registration by Selecting the SIM linked to your IDBI Bank Account

- Step 3: Follow the onscreen instruction and setup app login (PIN/Pattern/Biometric) followed by 6 digit CBDC Transaction PIN.

- Step 4: Link eligible IDBI Bank account (Savings, Current-Proprietor) with active and linked debit card.

- Step 5: Your Registration is completed, now you can load wallet and explore the digital currency of India in your mobile.

Features/Benefits

- India's own digital currency regulated by RBI

- Pay instantly via mobile number and QR

- Scan any UPI QR, pay instantly with CBDC

- Makes your account statement clutter free.

- Seamless and convenient daily payments with Auto Load feature

- Safe and secure transactions with Blockchain technology

FAQs

Central Bank Digital Currency (CBDC) is a digital form of India’s physical currency issued by RBI. It is legal tender and can be used for transactions, just like any physical ₹ note.

No. CBDC is backed by RBI and has intrinsic value, unlike cryptocurrencies which are decentralized and volatile.

A digital wallet provided by IDBI Bank to store and transact CBDC (Digital Rupee).

Eligible Savings/current account having active linked debit card and Bank registered mobile number required to activate eRupee wallet. Wallet Registration to be done via SIM data only.

With IDBI eRupee app user can transact with CBDC. Customers maintaining eligible account with IDBI Bank can register the digital rupee wallet app. This “eRupee” wallet will be like your physical wallet in digital form on your Android/iOS device.

Management of denominations is taken care by change management system of CBDC and the transaction will be processed, if otherwise in order. You can directly enter the amount in the enter amount filed to make payment.

Yes, QR codes support both CBDC and UPI payments.

In case you input the wrong PIN more than 3 times a day, then transaction on IDBI eRupee app will be temporarily blocked. Customers need to reset the Wallet PIN.

| Particulars | Limits |

|---|---|

| Holding capacity for wallet (Amount) | eRs.1,00,000/- |

| Per Transaction limit: | eRs. 10,000/- |

| Outward transfer limit + Redemption (24 hours): | eRs.50,000/- |

| Cooling Period limit for first 24 hrs after registration | Rs.5,000/- |

| No. of transactions in cooling period of 24 hrs | 20 |

| No of Outward Transaction Count (P2P) | 100 transactions in 30 days |

| No. of P2P txn in 24 hrs | 20 |

Wallet can be restored using registered SIM and credentials. And you can recover your wallet using the same phone number/SIM on IDBI eRupee App.

In case of emergencies customers can instantly block their wallets by simply sending an SMS CBDCBLOCK on 7799437634 to Bank. For more details customer can contact Bank customer care on customercare@idbi.co.in and 1800-209-4324